Portfolio

Analytics

(SaaS)

timsondesign.com

Transforming banking through personalized experiences.

In this digital age, delivering a personal banking experience that differentiates and drives more business is going to take data.

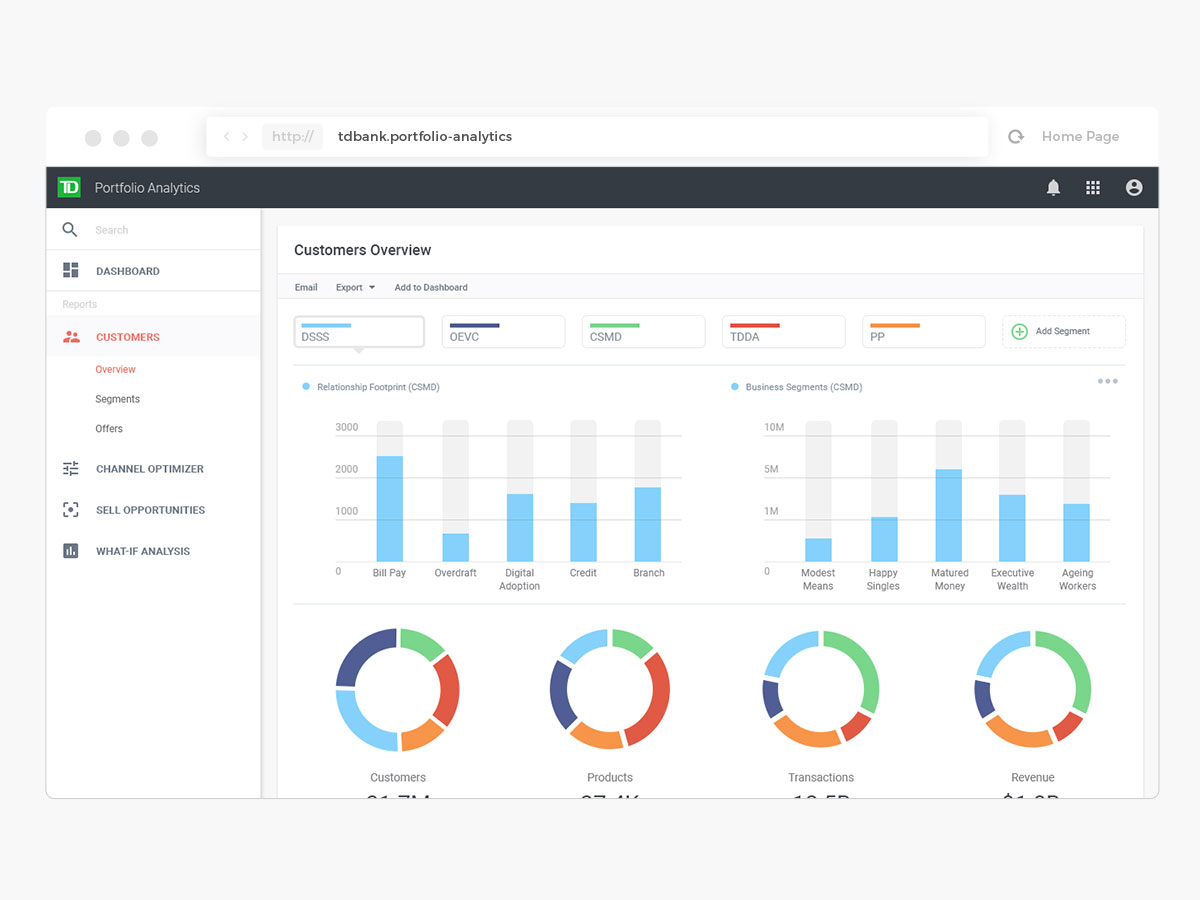

However, the data that banks and credit unions require to personalize the experience typically resides in disparate systems, each serving only one specific delivery channel.

As long as this data remains siloed, it will be extremely difficult to provide a superior and personalized banking experience.

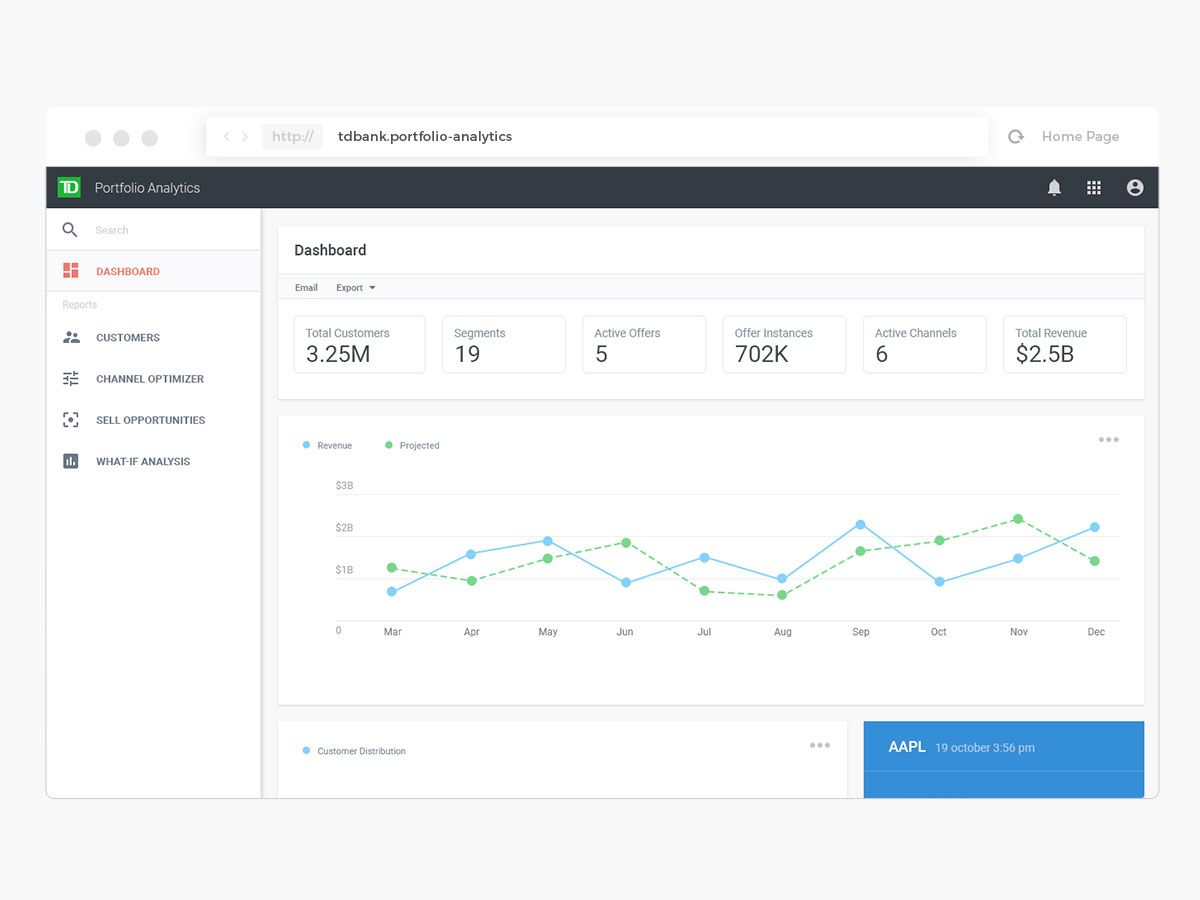

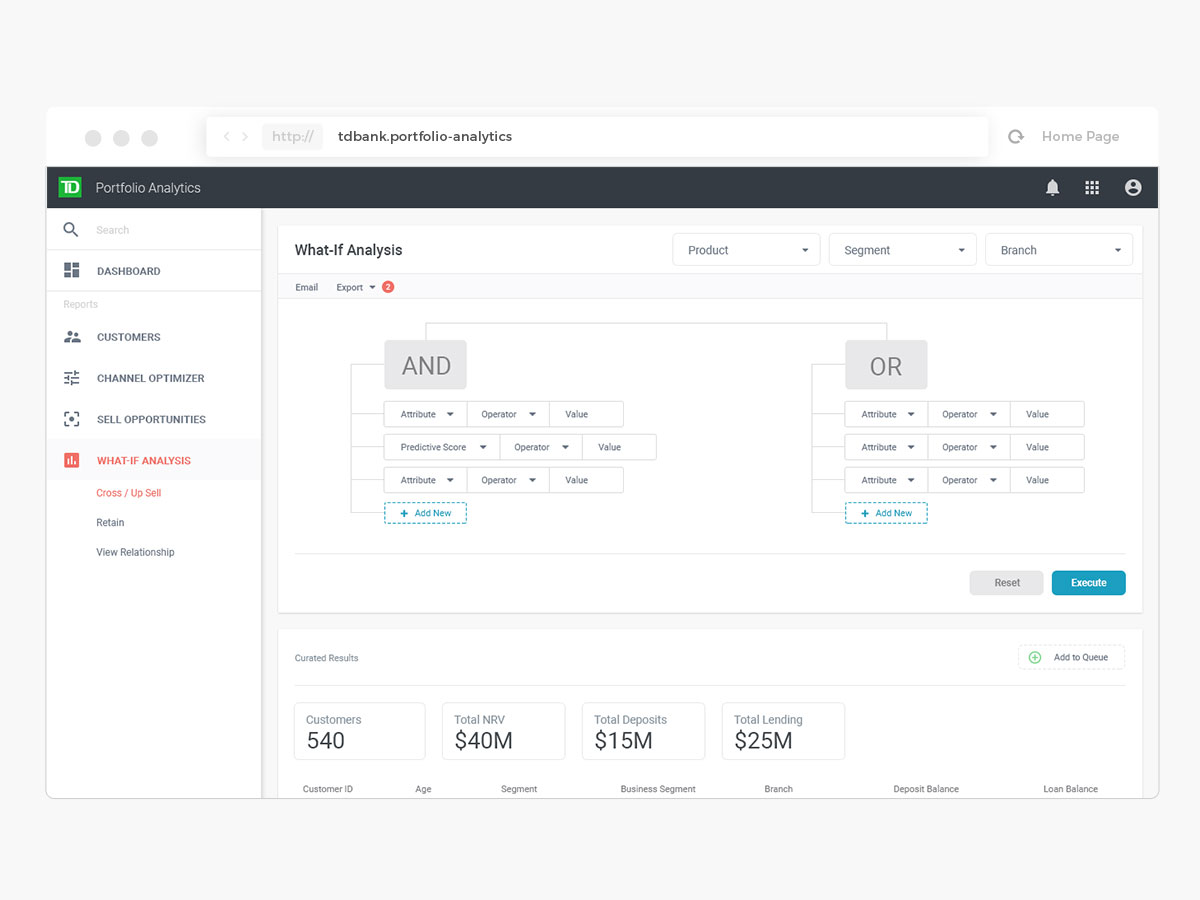

Our vision for Portfolio Analytics was to be the tool for Relationship Managers to use when dealing with customers. We did not want to offer an exhaustive list of irrelevant data, rather wanted to focus on the most critical indicators that are deeply personalized to the customers' needs.

Goal 1:

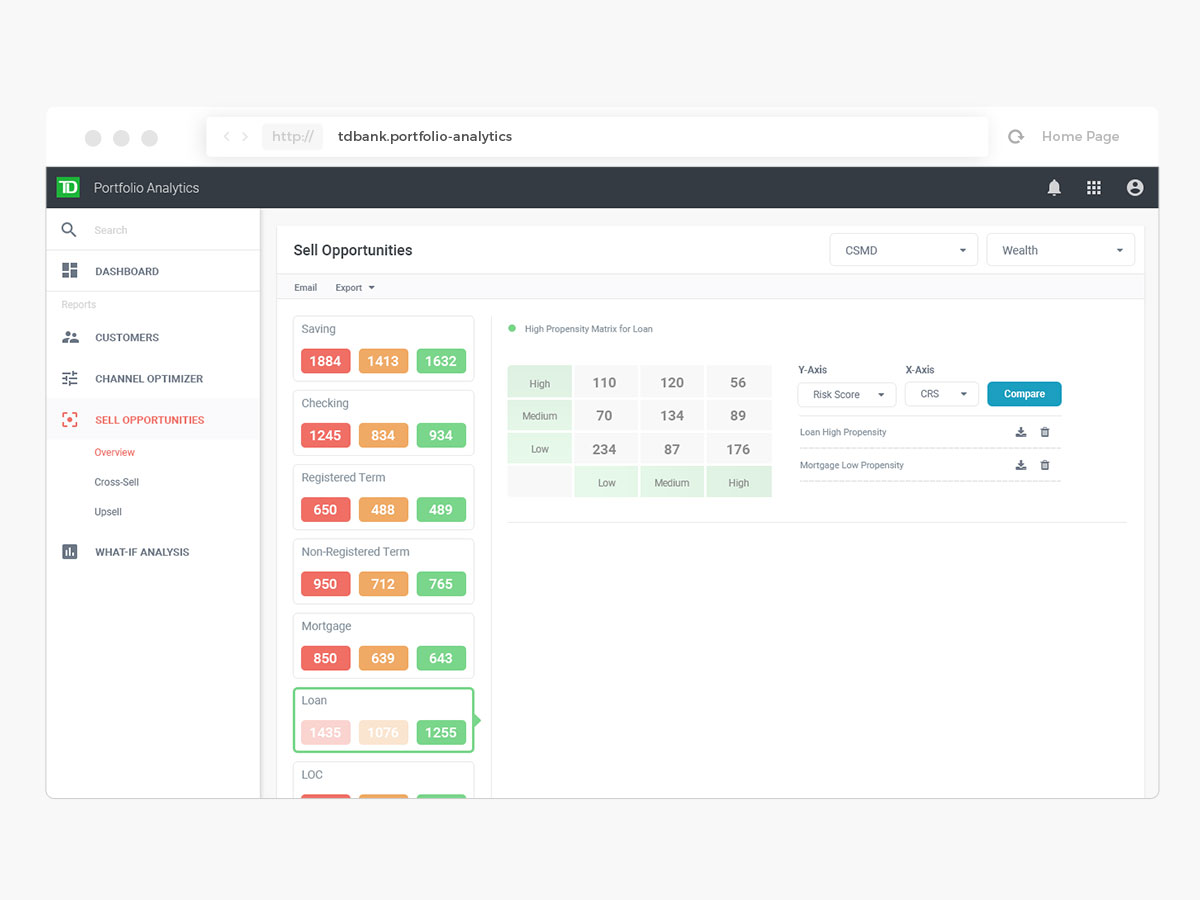

Leverage advanced analytics, machine learning and contextual engagement to provide a highly personalized experience by delivering uniquely personalized product offers.

Goal 2:

Increase retention by identifying and targeting clients exhibiting attrition risk behavior. Minimize channels cost by identifying and incentivizing activity with lower-cost channels.

I collaborated with a product owner and a business analyst to uncover insights and translate concepts into features that address customer behavior and motivation. I interviewed several relationship managers at local banks to understand their current process for offering personalized deals and how they would use our product in their daily activities. Additionally, I conducted a competitive analysis of similar products.

My research deepened my understanding of financial institutions' perspectives and customer expectations regarding personal finances. Collaborating with my project partners, we defined the product and aligned it with customer goals while balancing business objectives. I prioritized and negotiated features for both the initial launch and subsequent releases.

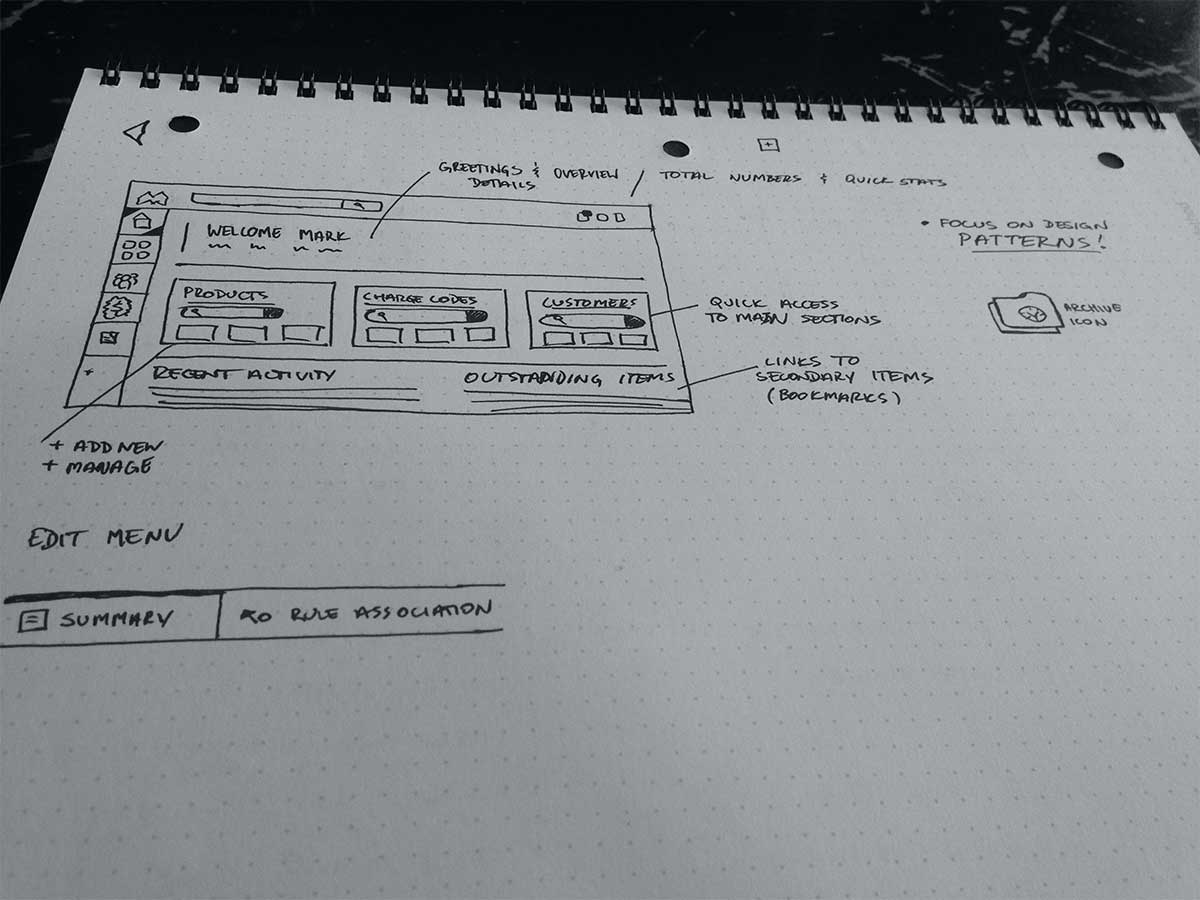

I conducted a hierarchical card sort with 10 participants to gain insights into how bankers perceived various content categories and prioritize them within the context of customer relationships. An equally crucial design challenge involved developing effective features, including test scenario engines capable of handling large datasets to offer relationship managers the most relevant course of action.

While acquiring the right data was crucial, managing the user experience without overwhelming users with numerous steps remained a significant challenge. Collaborating closely with end users and the team, I continuously tested prototypes and iterated progressively. For design testing, a small group of local relationship managers and bank managers volunteered to participate, ensuring a focused evaluation process.

There must be a shift in focus from mere product sales to offering relevant and contextual financial advice—banks need to show genuine interest and commitment to their customers' financial well-being. Since its launch, Portfolio Analytics has enabled retail banks to break through data silos and gain a comprehensive 360-degree view of customer activity. This has empowered them to make customer-centric decisions and adopt a design-focused approach to cross-selling, upselling, and addressing attrition, ultimately leading to improved customer retention and satisfaction.